Locating inexpensive automobile insurance coverage can be hard if you're a brand-new motorist. To get your ideal cars and truck insurance coverage price, contrast several quotes from different suppliers.

These can aid offset brand-new vehicle driver premium costs. After that, getting a policy ought to fast. This short article will cover: Exactly how a lot does vehicle insurance price for new motorists? Based on our research study, the ordinary cost of auto insurance for a new motorist is $4,762 a year, or $397 a month.

Your real cost for brand-new driver automobile insurance policy depends partly on the insurance company you choose and also the state you live in, to name a few aspects. The table listed below programs the average annual prices from various nationwide companies for full-coverage car insurance for new vehicle drivers. insurance. Exactly how to get cheap cars and truck insurance as a new motorist Plan alternatives, price cuts and car insurance firm programs are available to aid you get your ideal and also least expensive vehicle insurance policy prices as a brand-new motorist.

Sharing a vehicle insurance coverage with a parent If you're a young individual that's simply getting a driver's authorization, the most inexpensive automobile insurance option will possibly be to obtain on your parents' plan. Teenagers are taken into consideration the greatest threat group of motorists in the eyes of automobile insurance provider. Costs for teen motorists are infamously high.

Hopping on your moms and dads' insurance can shave hundreds of bucks off your auto insurance prices. It will still elevate their total annual premium, yet no place near the complete cost if you had your very own vehicle insurance coverage plan. To provide you a feeling of the price difference, the graph listed below shows the average expense of full-coverage automobile insurance policy for a new chauffeur with their own automobile insurance versus the average rate on a moms and dad's policy (vehicle).

Everything about Welcome To Bristol West Insurance Group

Jumping on an additional's auto insurance coverage can conserve over 50%. People who have actually never ever driven previously are considered high danger because of their strangeness with driving. This will come on time, as well as while these motorists are nowhere near as high a danger as teenager vehicle drivers, they still present one. New grown-up vehicle drivers see greater prices than seasoned chauffeurs of the very same age. business insurance.

The security degree of the cars and truck you drive can help minimize your risk of a crash. And some automobiles are substantially cheaper to fix than others, making their insurance policy prices lower (insure).

Who needs new motorist insurance coverage? If you're entirely brand-new to driving or haven't been behind the wheel in a while, automobile insurance providers will certainly charge you greater rates for a policy.

Significant auto insurance firms supply coverage to brand-new drivers, however they may not be your best choice. https://auto-insurance-south-houston-tx.s3.par01.cloud-object-storage.appdomain.cloud Ensure to inspect with neighborhood and also local automobile insurance policy business in your area. You can locate a cheaper rate. Also, bear in mind that getting on a vehicle insurance policy with a parent or partner might reduce your costs substantially.

com LLC makes no depictions or warranties of any kind, reveal or suggested, regarding the operation of this website or to the information, content, products, or items consisted of on this website. You expressly agree that your use this website is at your sole danger (low-cost auto insurance).

The cheapest firms for new drivers in 2021. insurers., Car Insurance Policy Writer, Nov 1, 2021.

4 Simple Techniques For How Much Does The Average Massachusetts Driver Pay For ...

cheaper cars cheapest car business insurance car insured

cheaper cars cheapest car business insurance car insured

If you have a new chauffeur in your household, you might wonder just how much is newbie vehicle driver insurance coverage? In auto insurance, the term "new chauffeur" refers to an individual that does not have any kind of driving background or document of insurance policy.

car insured car cheap insurance credit

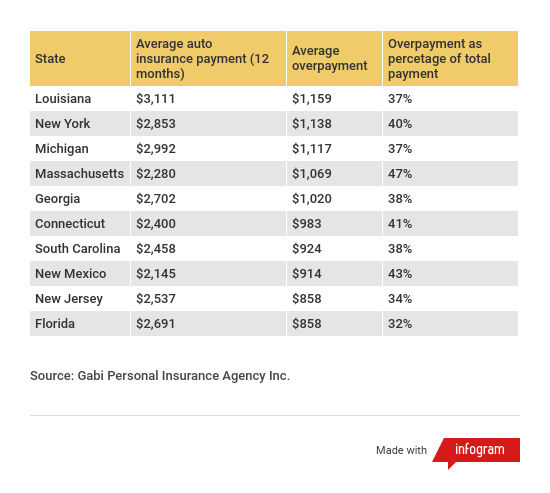

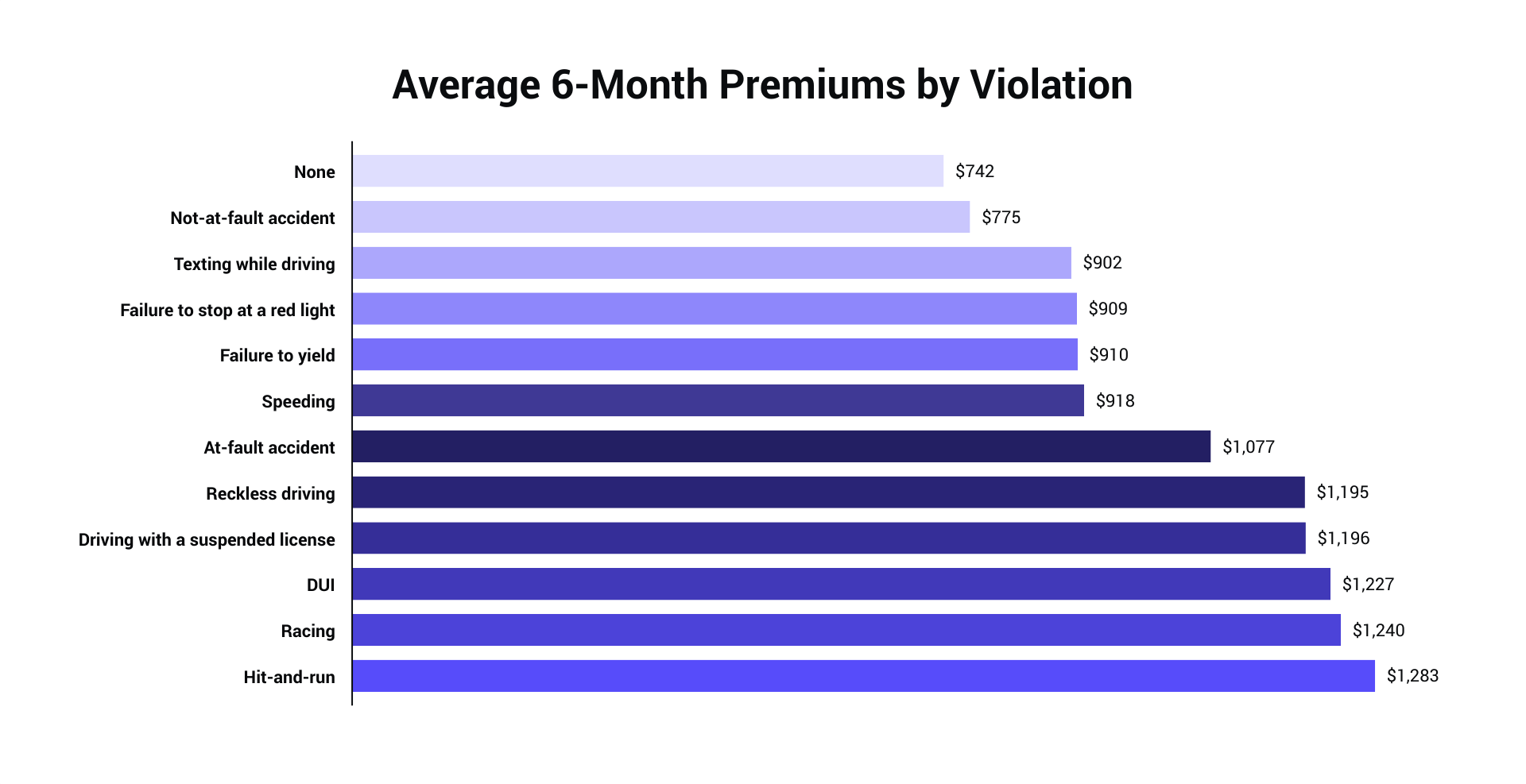

It's important to keep in mind, however, that insurance costs differ extensively. car insurance. Some of the aspects that insurance firms take right into account when determining the price of a plan include the following: Chauffeur's age, Motorist's driving background consisting of mishaps or infractions, Driver's credit report score, The vehicle's make and design, Chauffeur's address, Of these aspects, two lug the most weight: your driving record as well as where you live.

Along with penalties, these tickets can remain on your driving record for 3 to five years. Preventing violations can conserve you countless bucks. Where you live plays a function in the prices. If you live in an area with a high rate of burglary, your insurance policy prices will certainly increase to counter those costs.

What Are the Ideal Insurance Firms for New Drivers? Without an insurance policy background or driving experience, brand-new drivers are viewed as high-risk to guarantee, so companies frequently bill them prices.

It has price cuts for good pupils, those that finish a driver training program, and also has a Safe Pilot program that encourages risk-free driving practices. cheaper car. One thing that you need to remember that it's much more expensive to guarantee a novice chauffeur on a different plan than to include them on a family members plan.

auto insurance insurance low-cost auto insurance auto insurance

auto insurance insurance low-cost auto insurance auto insurance

Nevertheless, if you include that very same kid to a parent's policy, nonetheless, the annual expense has to do with $2,750. Premium costs do lower rather a little bit after more youthful drivers turn 20, but they still pay nearly two times as high as the typical U.S. driver, according to The Zebra. Exactly How Can First-Time Drivers Conserve Money on Car Insurance Coverage? To assist novice motorists save cash when they sign up for cars and truck insurance, they ought to take into consideration doing the following: Their parents' insurance background, driving history, and also credit report scores will likely earn newbie chauffeurs lower prices.

How What Determines The Price Of An Auto Insurance Policy? - Iii can Save You Time, Stress, and Money.

Are you questioning how much first-time chauffeur insurance coverage prices? Just since novice vehicle driver insurance policy could be expensive, it does not suggest that you have to pay the complete rate - vehicle insurance.

Resources: This material is produced as well as preserved by a 3rd party, as well as imported onto this page to aid users offer their email addresses. You might be able to locate even more information concerning this and also comparable material at.

If you have an interest in discovering an insurance representative in your area, click on the "Representative, Finder" link at any kind of time to go to that search tool. insurers. If you want discovering a representative that represents a particular company, you can additionally click on the business name in the costs contrast which will certainly connect you to that business's website.

When it involves insurance coverage, it pays to be a risk-free vehicle driver. Teenager drivers currently pay even more for automobile insurance policy than even more experienced vehicle drivers, and if you're not following the rules of the road, your costs will be even higher (cheap auto insurance). Insurance coverage business consider teens a higher danger, because unskilled vehicle drivers are a lot more likely to enter crashes.

Make certain you're comparing similar coverages when you're looking around (low cost). Why do I need car insurance coverage? Since its the regulation. In North Carolina, you are called for to have car liability protection to lawfully drive. Due to the fact that it aids you shield yourself monetarily. If you cause a mishap, insurance coverage aids spend for injuries as well as residential or commercial property damage you create to others.

cheap car automobile low cost risks

cheap car automobile low cost risks

If you drive without insurance ... You could be ticketed and fined. As a moms and dad, how can I maintain my teen chauffeur secure? If you are a moms and dad of a teen chauffeur, your child's safety is your first issue.

The 45-Second Trick For Car Insurance For Teens Guide

While teen driving statistics are uncomfortable, research study recommends parents who establish rules reduce accident threat in fifty percent. Talk honestly concerning your expectations for behind-the-wheel behavior. Develop a teen chauffeur agreement that clearly defines guidelines and also consequences connected with driving opportunities.

When it pertains to teen motorists as well as cars and truck insurance coverage, points obtain complex-- and also expensive-- quickly (car insurance). A moms and dad adding a male teenager to a plan can expect automobile insurance policy price to balloon to greater than $3,000 for complete protection. It's also higher if the teen has his very own plan.

cheapest car vehicle insurance perks cheapest

cheapest car vehicle insurance perks cheapest

Currently, that we have actually examined those serious facts, let's guide you through your automobile insurance policy buying. We'll look at discounts, choices and special conditions-- so you can locate the very best automobile insurance coverage for teens. Although the right response is typically to include a teen onto your policy to alleviate several of the expense, there are various other choices and discounts that can save money (vehicle).

In the end, you'll require to contrast vehicle insurance coverage prices estimate using our quote comparison tool to see which firm is best for you. Secret TAKEAWAYSAccording to the federal Centers for Disease Control and also Prevention, the most awful age for mishaps is 16. If the student plans to leave an auto in your home as well as the university is greater than 100 miles away, the university student could receive a "resident student" discount or a trainee "away" price cut.

IN THIS ARTICLEHow much is car insurance policy for teenagers? The younger the vehicle driver, the much more expensive the automobile insurance. Young drivers are much much more most likely to obtain into car accidents than older chauffeurs.

A research by the IIHS located states with more powerful finished licensing programs had a 30% lower deadly crash price for 15- to 17-year olds. Adding a teenager to your cars and truck insurance coverage, Including a young adult to your automobile insurance plan is the cheapest method to get your teen guaranteed. It still features a substantial expense, however you can definitely save if you select the best vehicle insurer for teenagers.

The smart Trick of Mercury Insurance: Auto, Home, Business Insurance & More That Nobody is Talking About

Then we included a 16-year old teen to the policy. Right here's what happened: The typical family's car insurance expense increased 152%. A teen child was more costly. The average bill increased 176%, compared to 129% for adolescent women (business insurance). The golden state rates boosted one of the most, more than 200%. The factor behind the hikes: Teens collision at a much greater rate than older vehicle drivers.

They have an accident price two times as high as drivers that are 18- as well as 19-year-olds. Expenses differ by insurance firm, which is the factor we recommend buying for teen chauffeur insurance coverage.

Simply make certain your teenager isn't driving on a full license without being formally included to your policy or their very own. That would be dangerous. If my teen obtains a ticket, will it elevate my prices?. Once with each other on the very same policy, all driving documents-- including your teenager's-- affect costs, for much better or even worse.

Can a teenager get their own cars and truck insurance plan? State regulations vary when it comes to a teen's ability to sign for insurance coverage.